How To Get Tax Forms Doordash . Via this form, you report all your annual. how can i access my tax forms? doordash partners with stripe to file 1099 tax forms that summarize your earnings or sales activities. Why do i need to provide my tax information to doordash? Should i provide my business’ tax information or my. We’ve put together some faqs to help you learn. when it’s time to file your doordash taxes, you need to claim all your eligible deductions on the correct cra forms. get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099. For example, report your business mileage deduction on form t2125, applying the standard mileage rate or your actual vehicle expenses, whichever is higher.

from financialpanther.com

We’ve put together some faqs to help you learn. get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099. Why do i need to provide my tax information to doordash? Should i provide my business’ tax information or my. when it’s time to file your doordash taxes, you need to claim all your eligible deductions on the correct cra forms. how can i access my tax forms? doordash partners with stripe to file 1099 tax forms that summarize your earnings or sales activities. Via this form, you report all your annual. For example, report your business mileage deduction on form t2125, applying the standard mileage rate or your actual vehicle expenses, whichever is higher.

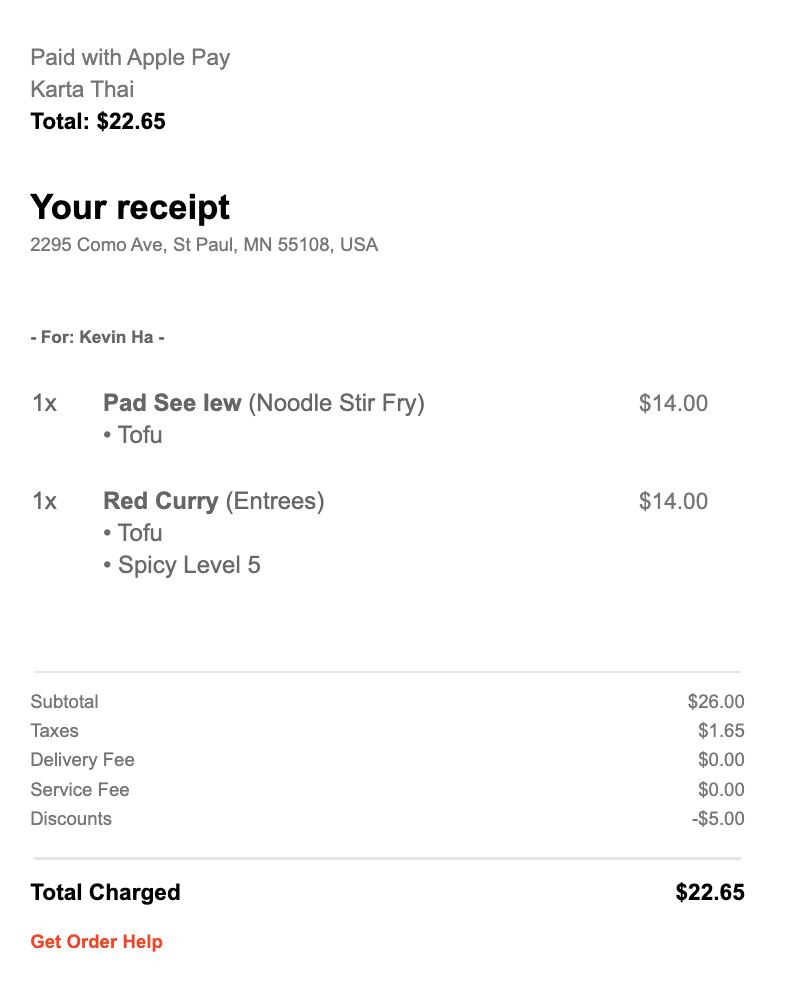

How To Get Your DoorDash Receipt Financial Panther

How To Get Tax Forms Doordash For example, report your business mileage deduction on form t2125, applying the standard mileage rate or your actual vehicle expenses, whichever is higher. Should i provide my business’ tax information or my. Why do i need to provide my tax information to doordash? doordash partners with stripe to file 1099 tax forms that summarize your earnings or sales activities. get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099. when it’s time to file your doordash taxes, you need to claim all your eligible deductions on the correct cra forms. For example, report your business mileage deduction on form t2125, applying the standard mileage rate or your actual vehicle expenses, whichever is higher. Via this form, you report all your annual. We’ve put together some faqs to help you learn. how can i access my tax forms?

From www.youtube.com

How to Get Doordash W2 Tax Form Online 2024 YouTube How To Get Tax Forms Doordash when it’s time to file your doordash taxes, you need to claim all your eligible deductions on the correct cra forms. how can i access my tax forms? For example, report your business mileage deduction on form t2125, applying the standard mileage rate or your actual vehicle expenses, whichever is higher. doordash partners with stripe to file. How To Get Tax Forms Doordash.

From taxleopard.com.au

TaxLeopard Tax App for Door Dash Drivers How To Get Tax Forms Doordash when it’s time to file your doordash taxes, you need to claim all your eligible deductions on the correct cra forms. doordash partners with stripe to file 1099 tax forms that summarize your earnings or sales activities. We’ve put together some faqs to help you learn. how can i access my tax forms? For example, report your. How To Get Tax Forms Doordash.

From www.youtube.com

How To Get DoorDash Tax 1099 Forms 🔴 YouTube How To Get Tax Forms Doordash when it’s time to file your doordash taxes, you need to claim all your eligible deductions on the correct cra forms. Why do i need to provide my tax information to doordash? Via this form, you report all your annual. how can i access my tax forms? For example, report your business mileage deduction on form t2125, applying. How To Get Tax Forms Doordash.

From www.youtube.com

How to GET MONEY BACK on YOUR TAXES / TAX DEDUCTIONS With DOORDASH How To Get Tax Forms Doordash when it’s time to file your doordash taxes, you need to claim all your eligible deductions on the correct cra forms. how can i access my tax forms? doordash partners with stripe to file 1099 tax forms that summarize your earnings or sales activities. For example, report your business mileage deduction on form t2125, applying the standard. How To Get Tax Forms Doordash.

From apc1040.com

Impuestos DoorDash 1099 NEC ¡Lo que necesita saber! How To Get Tax Forms Doordash how can i access my tax forms? For example, report your business mileage deduction on form t2125, applying the standard mileage rate or your actual vehicle expenses, whichever is higher. Should i provide my business’ tax information or my. get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099.. How To Get Tax Forms Doordash.

From www.pinterest.com

A complete guide to Doordash taxes, learn how to get your tax form and How To Get Tax Forms Doordash Via this form, you report all your annual. when it’s time to file your doordash taxes, you need to claim all your eligible deductions on the correct cra forms. doordash partners with stripe to file 1099 tax forms that summarize your earnings or sales activities. We’ve put together some faqs to help you learn. how can i. How To Get Tax Forms Doordash.

From www.youtube.com

Getting Tax Forms from Doordash EVERYTHING You MUST Know!! YouTube How To Get Tax Forms Doordash We’ve put together some faqs to help you learn. Via this form, you report all your annual. when it’s time to file your doordash taxes, you need to claim all your eligible deductions on the correct cra forms. get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099. Why. How To Get Tax Forms Doordash.

From support.stripe.com

Guide to 1099 tax forms for DoorDash Dashers and Merchants Stripe How To Get Tax Forms Doordash how can i access my tax forms? get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099. Via this form, you report all your annual. Why do i need to provide my tax information to doordash? when it’s time to file your doordash taxes, you need to claim. How To Get Tax Forms Doordash.

From entrecourier.com

Guide to Doordash 1099 Forms and Dasher How To Get Tax Forms Doordash when it’s time to file your doordash taxes, you need to claim all your eligible deductions on the correct cra forms. get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099. Should i provide my business’ tax information or my. how can i access my tax forms? Via. How To Get Tax Forms Doordash.

From support.stripe.com

Guide to 1099 tax forms for DoorDash Dashers Stripe Help & Support How To Get Tax Forms Doordash We’ve put together some faqs to help you learn. For example, report your business mileage deduction on form t2125, applying the standard mileage rate or your actual vehicle expenses, whichever is higher. doordash partners with stripe to file 1099 tax forms that summarize your earnings or sales activities. when it’s time to file your doordash taxes, you need. How To Get Tax Forms Doordash.

From locall.host

5 Simple Steps to Successfully Download Your Doordash Tax Form How To Get Tax Forms Doordash Why do i need to provide my tax information to doordash? Via this form, you report all your annual. how can i access my tax forms? Should i provide my business’ tax information or my. For example, report your business mileage deduction on form t2125, applying the standard mileage rate or your actual vehicle expenses, whichever is higher. . How To Get Tax Forms Doordash.

From flyfin.tax

The Complete Guide To Doordash Taxes How To Get Tax Forms Doordash doordash partners with stripe to file 1099 tax forms that summarize your earnings or sales activities. get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099. For example, report your business mileage deduction on form t2125, applying the standard mileage rate or your actual vehicle expenses, whichever is higher.. How To Get Tax Forms Doordash.

From www.youtube.com

Doordash How to File Tax YouTube How To Get Tax Forms Doordash how can i access my tax forms? Why do i need to provide my tax information to doordash? get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099. when it’s time to file your doordash taxes, you need to claim all your eligible deductions on the correct cra. How To Get Tax Forms Doordash.

From www.youtube.com

How Do I Get My 1099 from Doordash? YouTube How To Get Tax Forms Doordash when it’s time to file your doordash taxes, you need to claim all your eligible deductions on the correct cra forms. For example, report your business mileage deduction on form t2125, applying the standard mileage rate or your actual vehicle expenses, whichever is higher. Via this form, you report all your annual. how can i access my tax. How To Get Tax Forms Doordash.

From www.youtube.com

DOORDASH DRIVER How to Get Your 1099 TAX FORM YouTube How To Get Tax Forms Doordash For example, report your business mileage deduction on form t2125, applying the standard mileage rate or your actual vehicle expenses, whichever is higher. how can i access my tax forms? We’ve put together some faqs to help you learn. Why do i need to provide my tax information to doordash? Should i provide my business’ tax information or my.. How To Get Tax Forms Doordash.

From www.youtube.com

How To File 1099 Taxes Properly (Uber, Doordash, Lyft, Etc.) YouTube How To Get Tax Forms Doordash when it’s time to file your doordash taxes, you need to claim all your eligible deductions on the correct cra forms. We’ve put together some faqs to help you learn. how can i access my tax forms? get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099. . How To Get Tax Forms Doordash.

From www.taxfyle.com

The Ultimate 2023 DoorDash Tax Guide 1099 Tax Form and Filing for How To Get Tax Forms Doordash get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099. Via this form, you report all your annual. doordash partners with stripe to file 1099 tax forms that summarize your earnings or sales activities. For example, report your business mileage deduction on form t2125, applying the standard mileage rate. How To Get Tax Forms Doordash.

From jackeesuperstar.blogspot.com

How Do I Get My 1099 From Doordash 2020 Armando Friend's Template How To Get Tax Forms Doordash For example, report your business mileage deduction on form t2125, applying the standard mileage rate or your actual vehicle expenses, whichever is higher. doordash partners with stripe to file 1099 tax forms that summarize your earnings or sales activities. Via this form, you report all your annual. get the 411 on doordash tax forms and filing for dashers. How To Get Tax Forms Doordash.